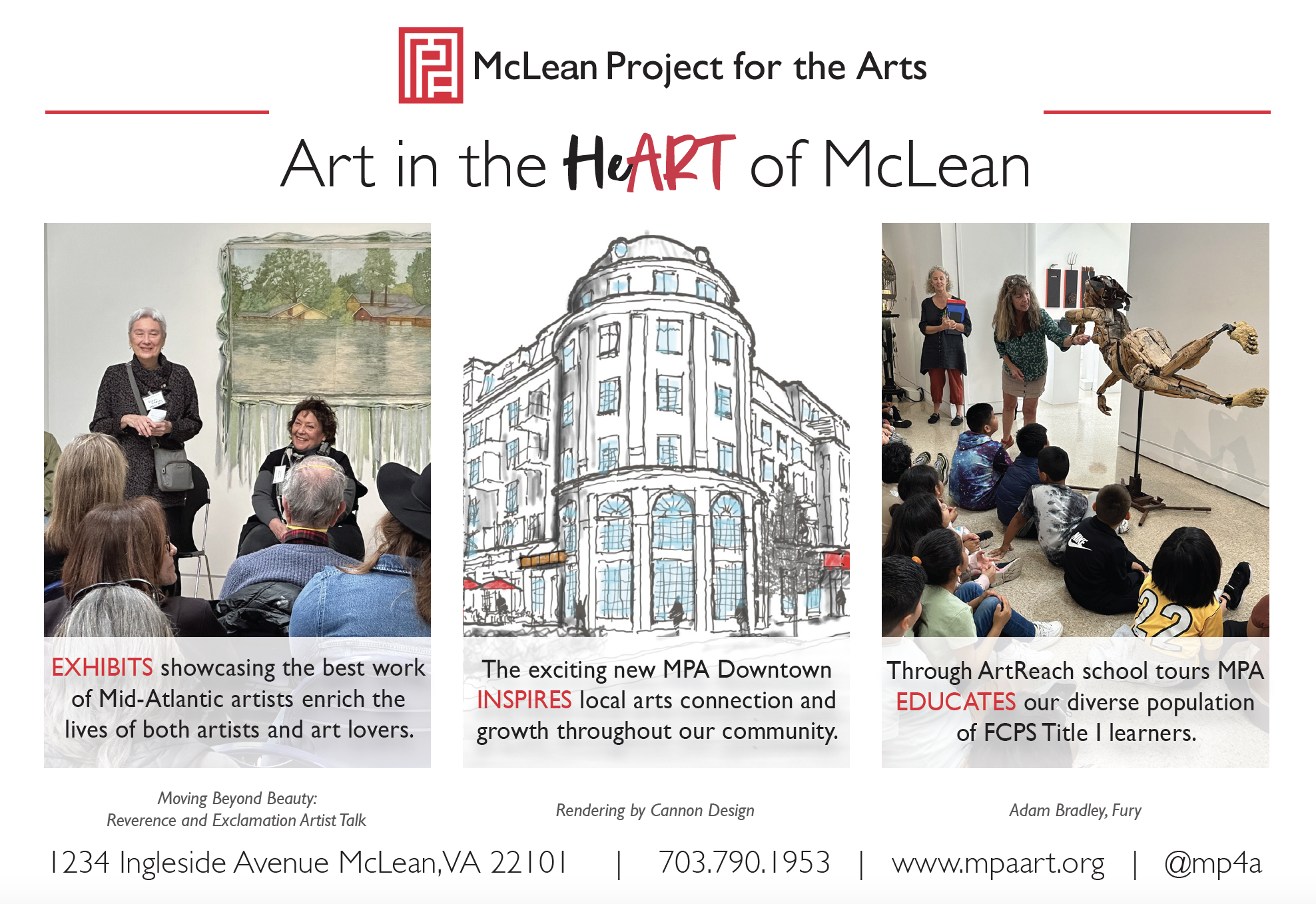

Thank you for being a vital part of MPA’s journey to inspire, create, and build a legacy of connecting art and community!

Suggested Levels of Support*

- $50 Friend

Shows your support for MPA’s mission. - $150 Community Partner

Supports MPA’s community programs. - $250 Art Supplies

Provides essentials for our K-6, senior, and disability programs. - $500 Summer Camp Scholarship

Funds a full-day camp for a student in need. - $1,000 Artist Recognition

Honors artists in our 2025 Spring Solo Exhibitions. - $2,500 MPA ArtReach

Supports transportation for students from under-resourced schools. - $3,500 MPA Sustainer

Includes 2 VIP tickets to our Spring Benefit. - $5,000 Celebrate Art

Sponsor a 2025 exhibition opening reception. - $7,500 Capital Kickstart

Name a ceramics wheel in the new MPA Studio (10 available).

*In the event that amounts raised exceed expenses for these programs, funds will be used for general operating expenses.

MPA offers these payment options:

Online:

Make a secure online or recurring payment with your credit card. Click here to give.

By mail:

Send in a check with this MPA Donation Form and mail to:

McLean Project for the Arts

Attn: Annual Giving

1234 Ingleside Avenue

McLean, VA 22101

Questions? Email giving@mpaart.org.

McLean Project for the Arts is a non-profit 501(c)3 charitable organization,

with the tax identification number of EIN #52-1374407. Your donation is considered

a charitable contribution under the U.S. Tax Laws. Consult your tax advisor to

determine the extent of the applicable tax deduction.

This is a unique year for giving and there are many ways to show your support of MPA. Consider gifts of securities, donor advised funds, bequests, and charitable lead and remainder trusts.

Make a monthly gift at any level. Your recurring monthly donation provides a reliable source of funding for all of MPA’s year-round programs.

A donor advised fund, which is like a charitable savings account, gives an individual the flexibility to recommend how much and how often money is granted to a non profit. Check with your financial advisor to request a grant or recurring grants for MPA.

MPA is happy to work with you on making gifts of publicly traded securities that have appreciated in value.

Please contact MPA for more information about making a gift of securities, and to ensure your account is properly credited.

Many employers will match your charitable contribution with an equal or higher amount if you or your spouse are an employee, retiree, or board member of a company. Check with your company to see if they have a matching gifts program and to request a matching gift form. Email or mail the completed and signed form with your gift to MPA.